nh food tax rate

Town of Londonderry 603 432-1100. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

So the tax year 2022 will start from july 01 2021 to june 30 2022.

. At LicenseSuite we offer affordable. The cost of a New Hampshire Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors. Meals paid for with food stampscoupons.

Prepared Food is subject to special sales tax rates under New Hampshire law. So the tax year 2022 will start from july 01 2021 to june 30 2022. New hampshire does not have any state income tax on wages.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. The federal corporate income tax by. 12 Mountain View Drive Strafford NH 03884.

45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. This is followed by Berlin.

New hampshire does not have any state income tax on wages. A 9 tax is also assessed on motor. Tax rate drops from 9 to 85.

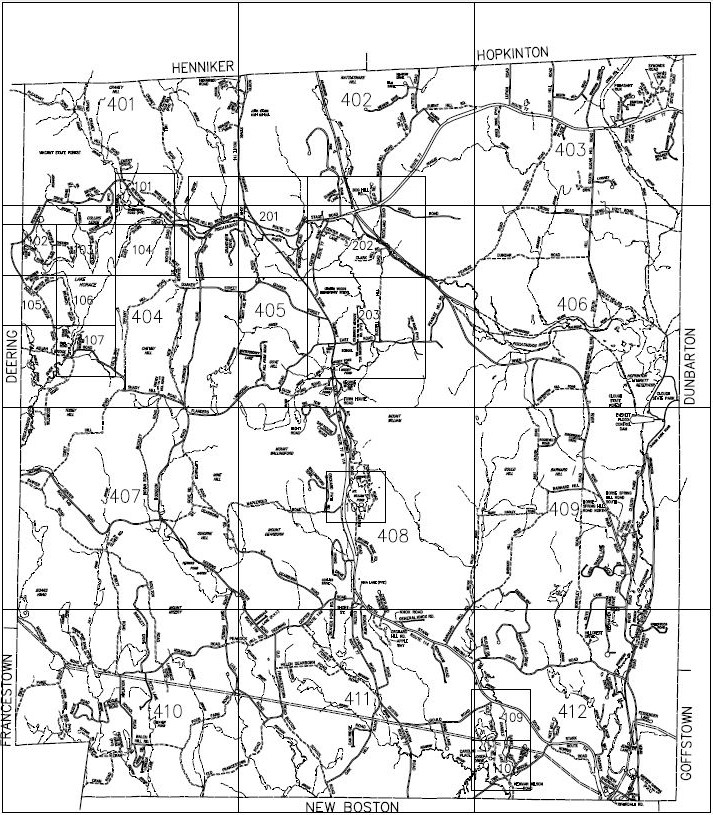

The tax rate for each package containing 20 cigarettes or little cigars is 178 per package. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and.

New Hampshire has a flat corporate income tax rate of 8500 of gross income. New Hampshire meals and rooms tax rate drops beginning Friday. Tax Bracket gross taxable income Tax Rate 0.

2021 Tax Rate2021 Tax Rate. Which New Hampshire Towns have the Highest Property Tax Rate. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

PO Box 23 Ctr. The tax rate for each package containing 25 cigarettes or little cigars is 223 per. 268B Mammoth Road Londonderry NH 03053.

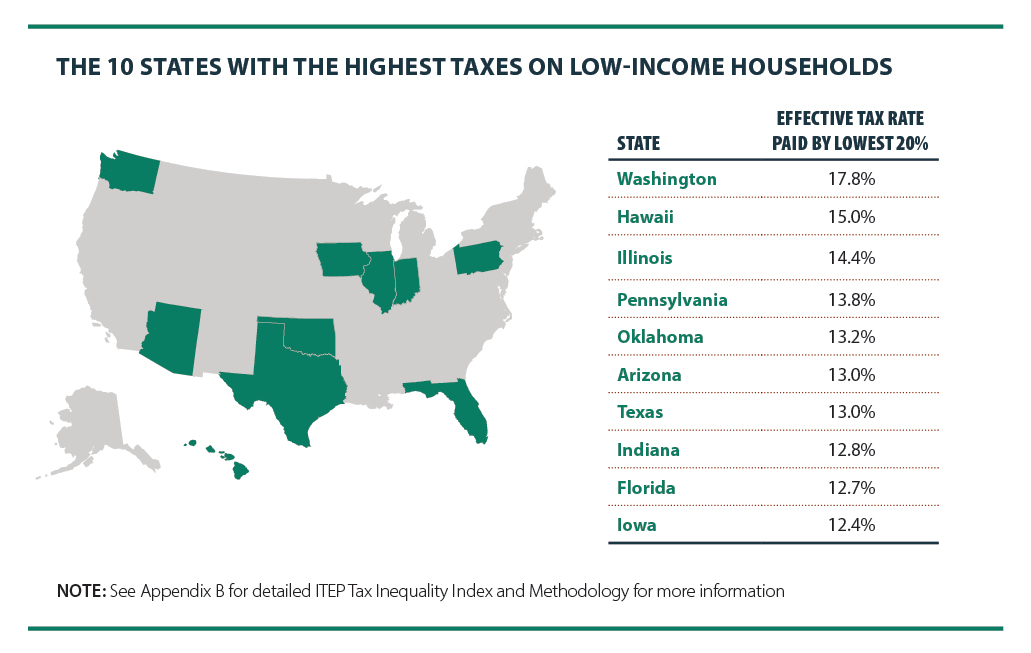

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. Meals paid for with food stampscoupons.

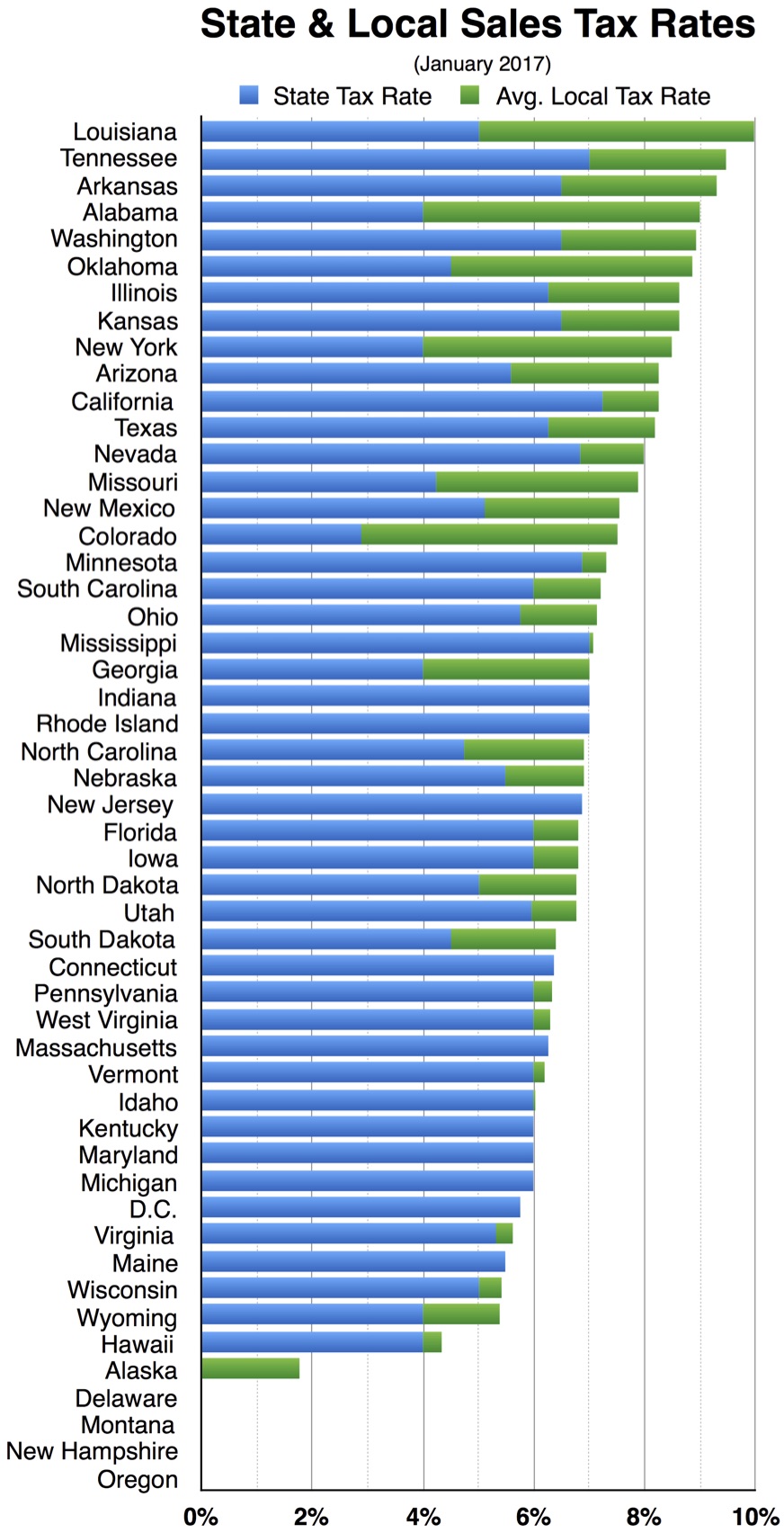

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Sales Taxes In The United States Wikipedia

Amazon Sales Tax Everything You Need To Know Sellbrite

Sales Taxes In The United States Wikipedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Meals And Rooms Tax Nh Issue Brief Citizens Count

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

Illinois Gas Taxes Among Highest In Nation Axios Chicago

New Hampshire Sales Tax Handbook 2022

Nh Families Continue To Fight Food Insecurity

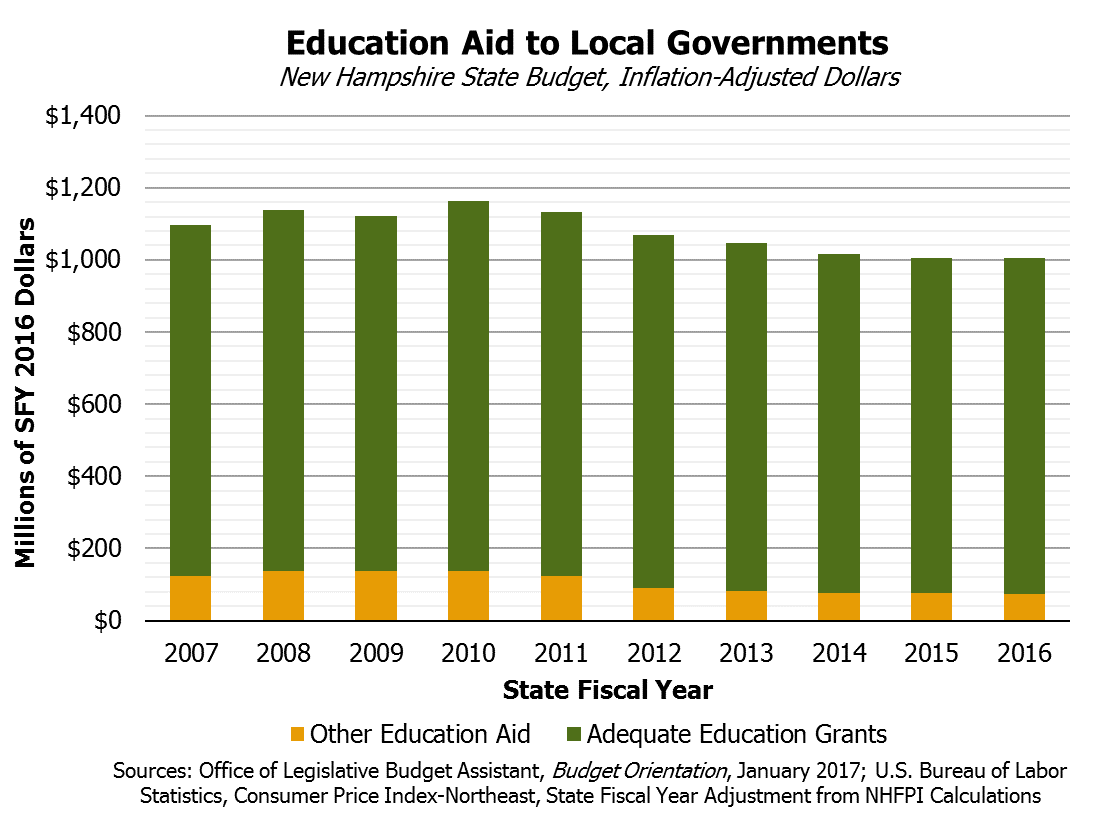

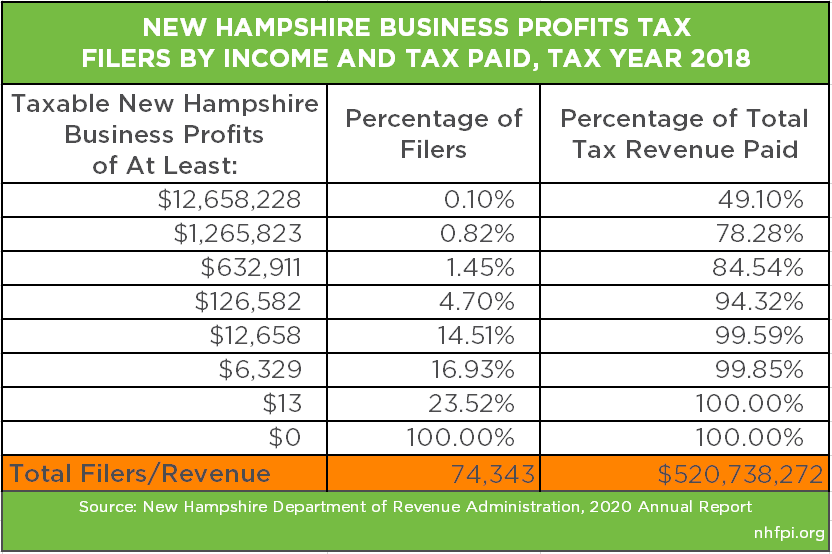

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire Sales Tax Rate 2022